PocketBudget

Handling finances has become challenging due to inflation. In this time-consuming work our team decided to help people organize their budget better. PocketBudget, a financial management application for customers who have difficulty controlling their budget and want to improve it.

First, the plan

02 Ideas

03 Tests

04 Design

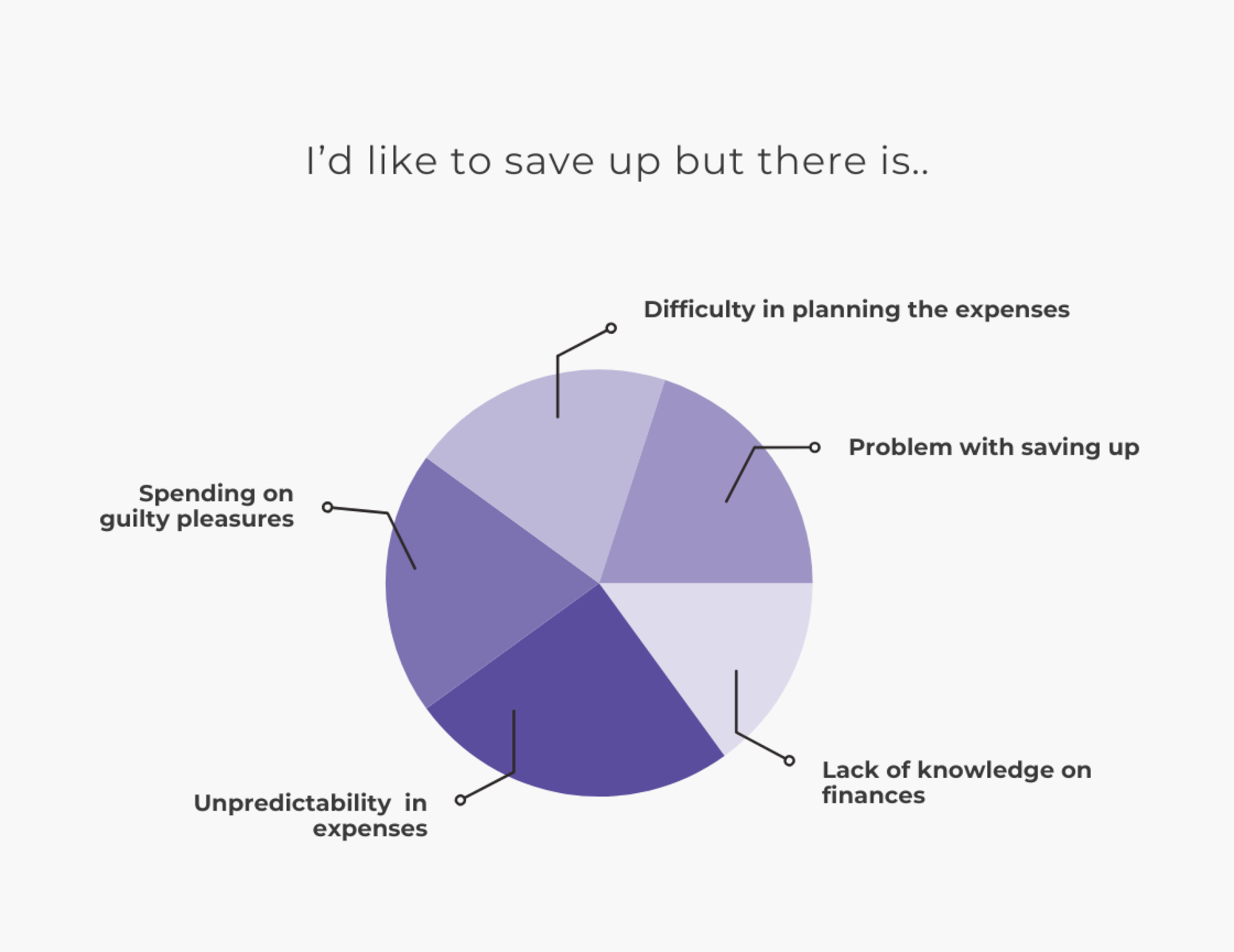

People find it difficult to manage their finances for various reasons. Many of them arise from the fact that it’s a time-consuming process and pretty monotonous. Not everyone wants to sit down quietly every month and write down all expenses and incomes in an Excel sheet table.

Time is one thing, but understanding

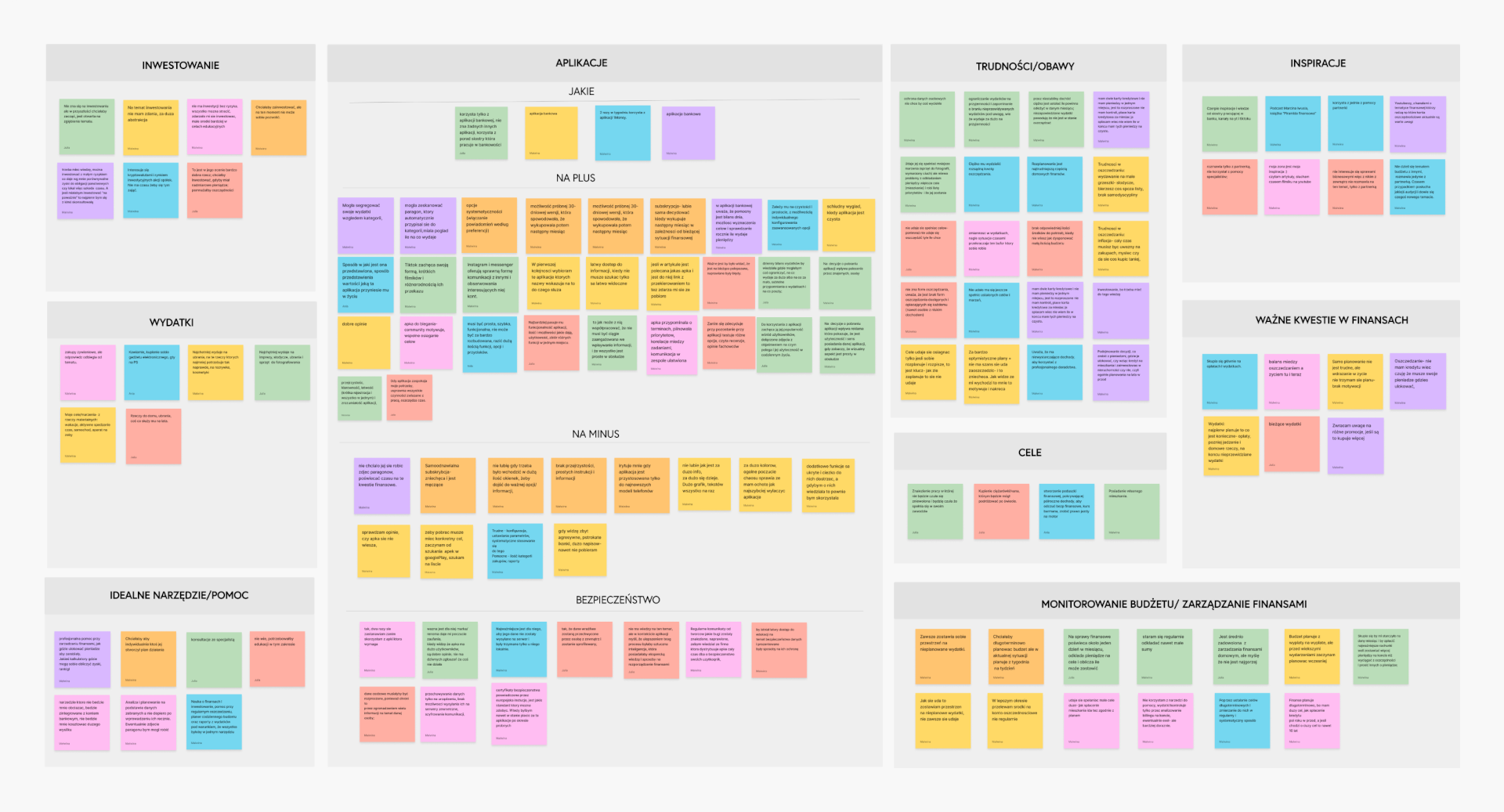

We began our research with creating questionnairies and preparing for interviews. From our seven meetings face to face and a review of money saving and tracking applications, we concluded that people don’t know where to get knowledge from when it comes to better understanding of their finances. The applications we analyzed didn’t offer user support, nor did they provide education on this topic. This led us to form the basis of our hypothesis.

Problem: Lack of external and personalized support from financial applications. Hypothesis: People want to improve their money management skills and understand money management better. Goal: Build an app that helps meet goals and improve the financial management process while educating the user.

Missed opportunities

Interviews helped us receive a broader picture on how daily management of finances looks like. Our main goal was to understand what problems were encountered, what influenced the daily choices and what would help us all be more content with our budget. The response was strikingly similar from a person to a person interviewed. Results of the interviews showed that main cause of dissatisfaction were: • Difficulty in planning the expenses • Lack of knowledge of finances • Problems with saving up for long term goals • Unpredictability in expenses • Guilty pleasures

Two approaches, one goal

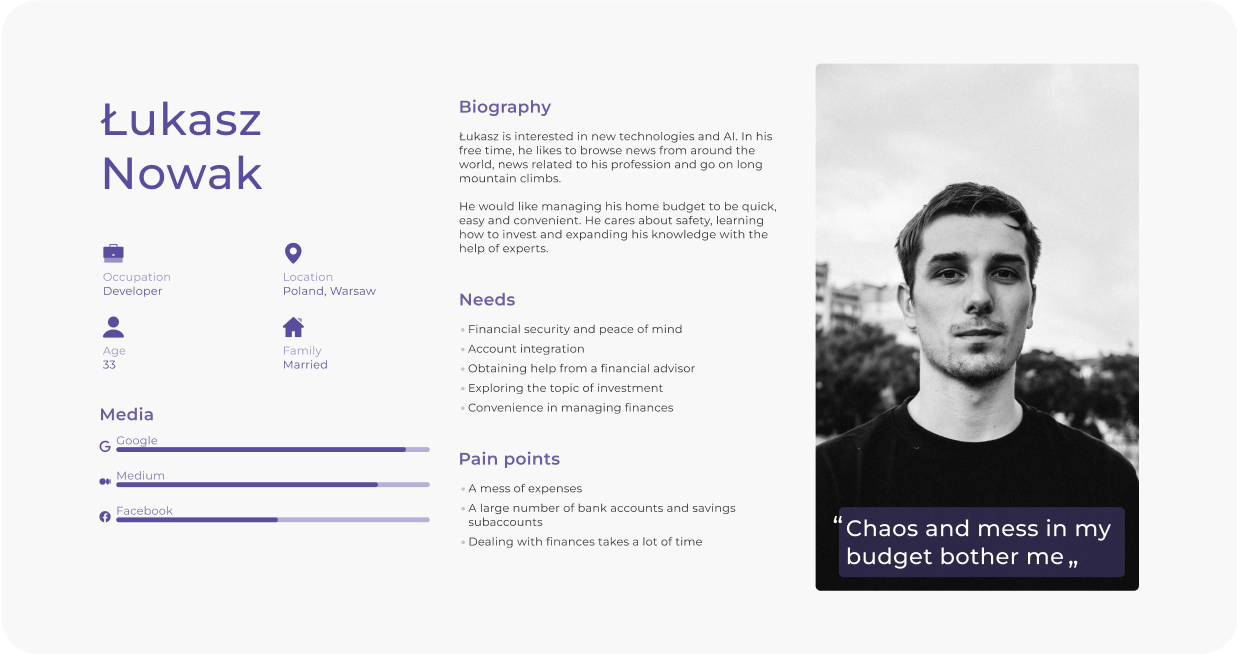

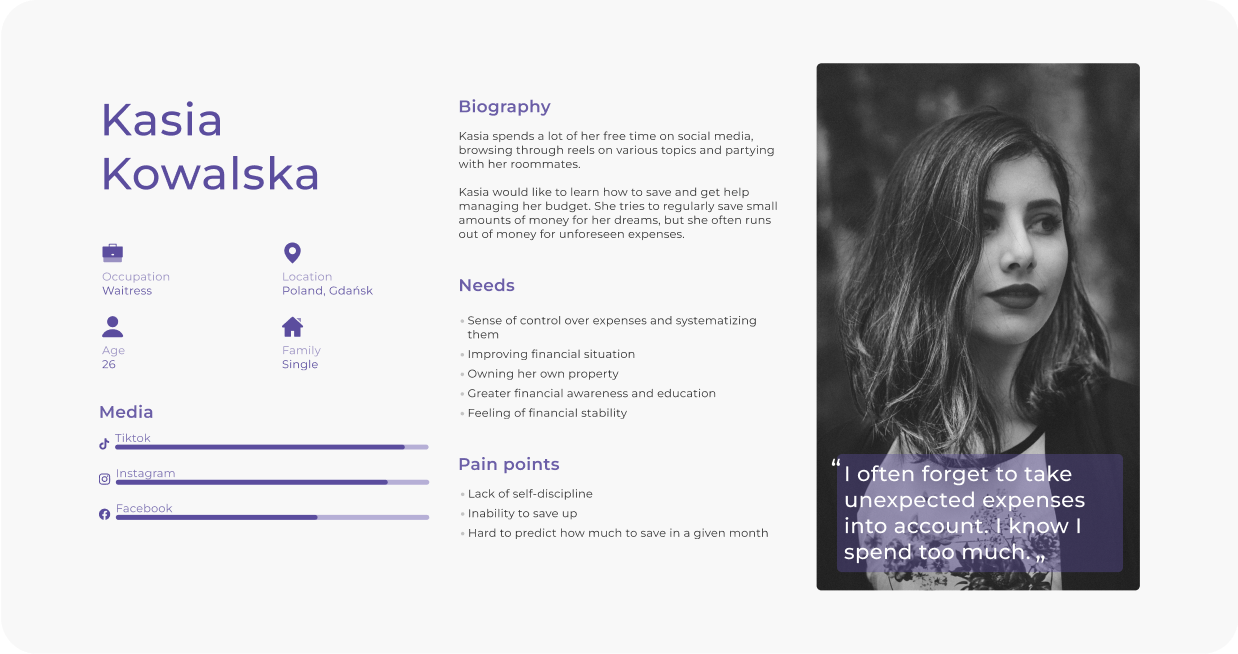

After gathering and categorizing answers by similarities and shared needs and concerns we began to notice two forming approaches. Therefore, in the conducted interviews, we identified two main personas. 01. Łukasz, a 33 years old developer, who has a stable financial situation and is interested in optimizing their budget management. 02. Kasia, a young student who has recently started earning money and has little financial awareness or discipline. However, is willing to save money regularly.

Predicting the next step

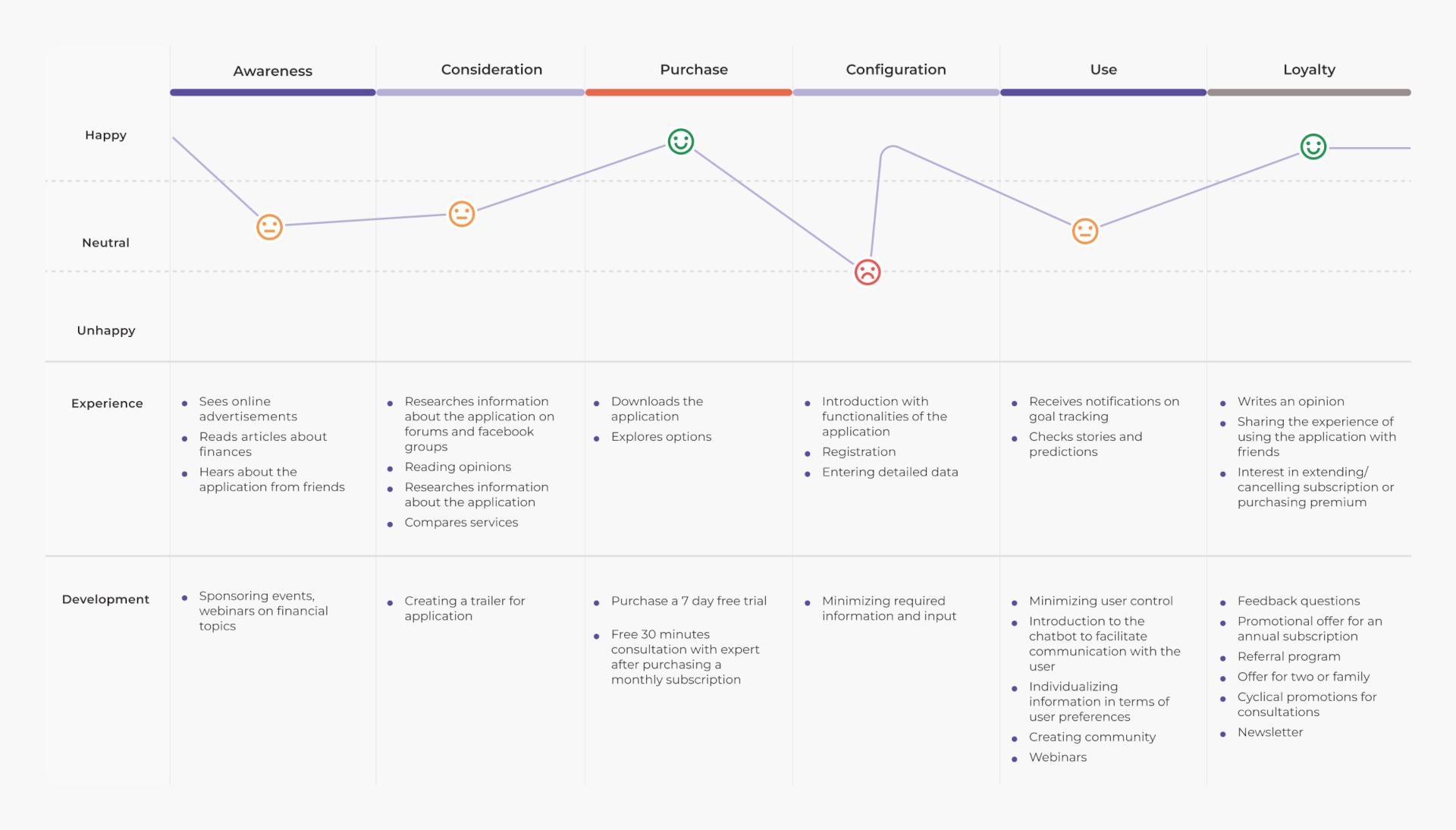

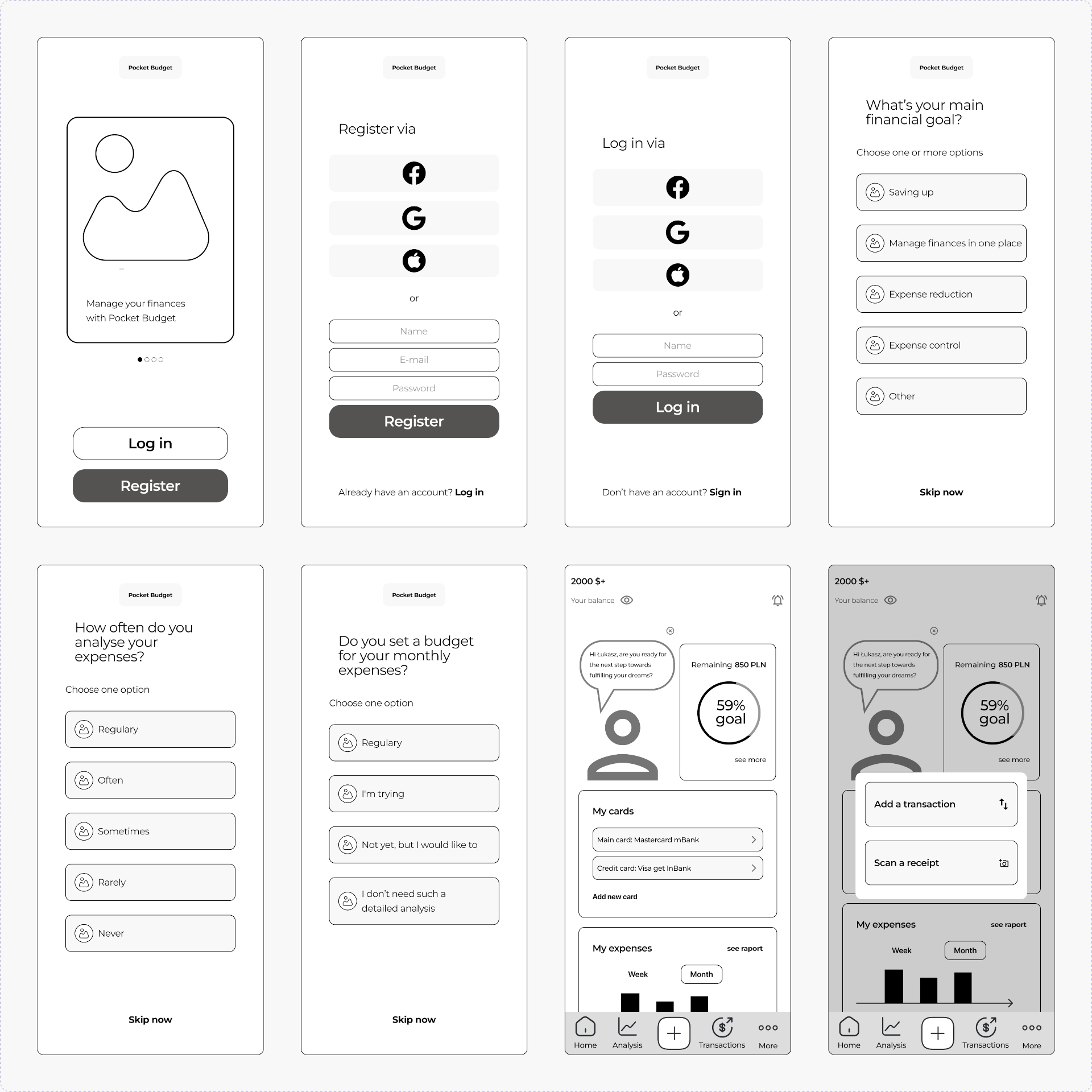

It was very important to prepare an easy and non invasive way to encourage trying a new way of balancing finances. In a User Journey Map our team envisaged a path of app download, setup, use and loyalty. We tried to find the points at which something could go wrong and find optimal solutions such as minimising user control and being able to individualize information in terms of user preferences. In order to trust an application more, our team minimazed required input on personal information since no one is likely to give away too many private details.

Ideas

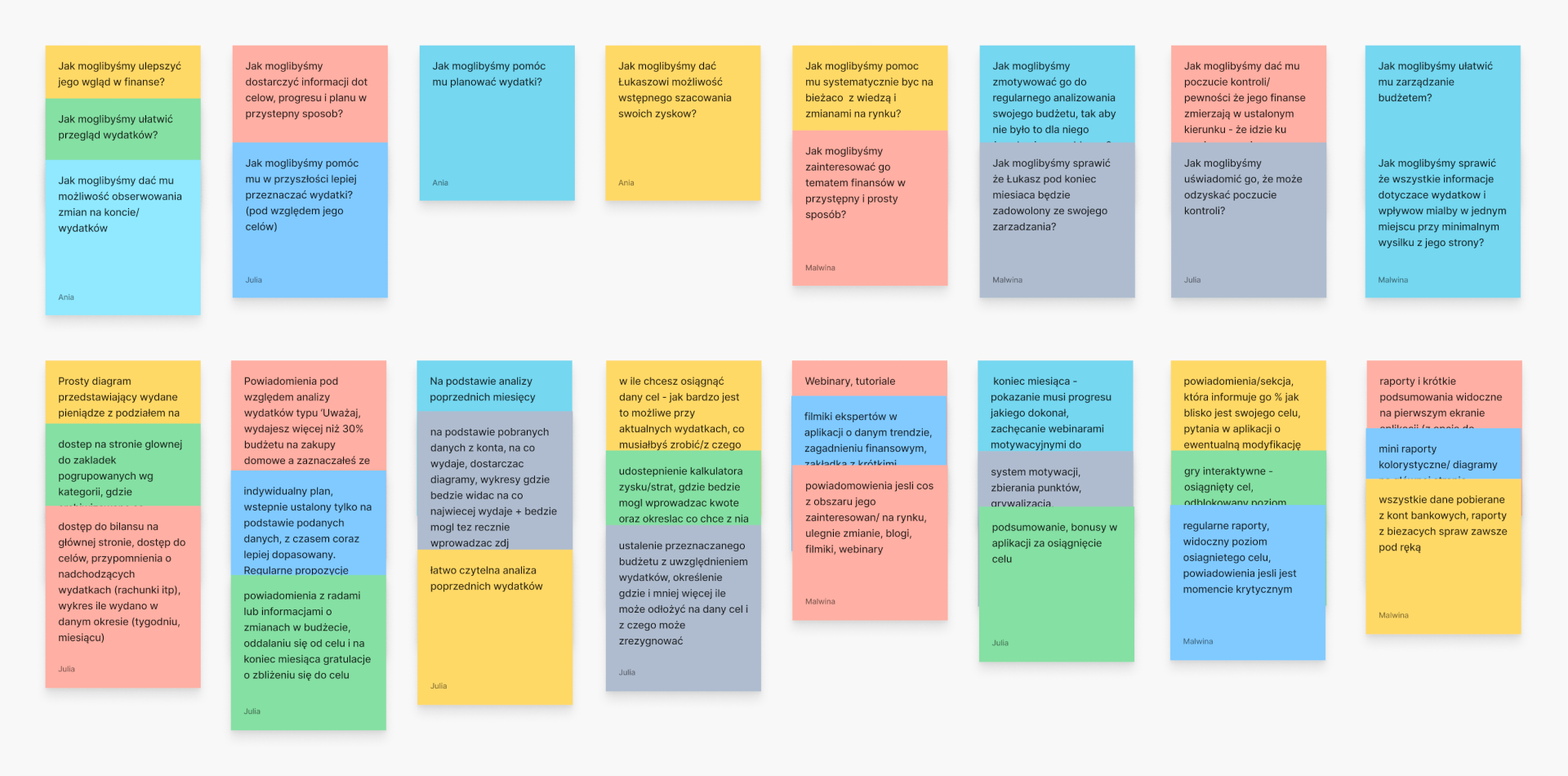

When we began to gather ideas over how might we help in having more control over finances, we found many new, interesting ideas that would not only create solutions for the analytics of incomes and expenses in the application, but also develop the educational and supportive side of it.

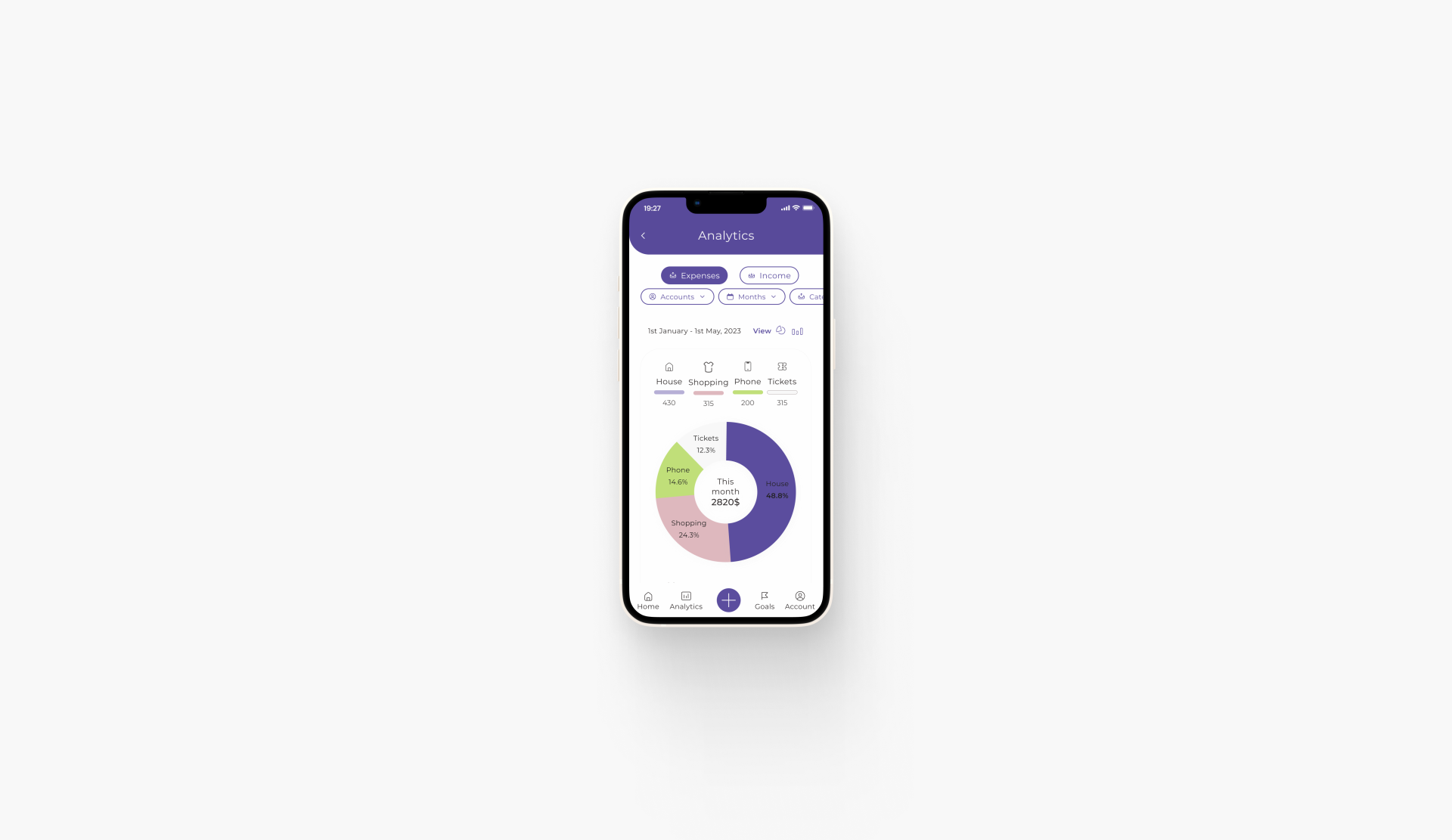

In help came a competition analysis. Our team researched seven applications including: MoneyLover, Money Manager, Monefy, Mój skarbiec, Spendee budget, Money Tracker and Revolut. Their common main function was to control and analyze expenses. From the analysis we identified few the most important and useful ideas, which help staying on track in an engaging way, such as: • Gamification • Setting targets for specific categories • Filtering reports by periods • Clear and easy to understand graphs of finances and timelines

Three branches

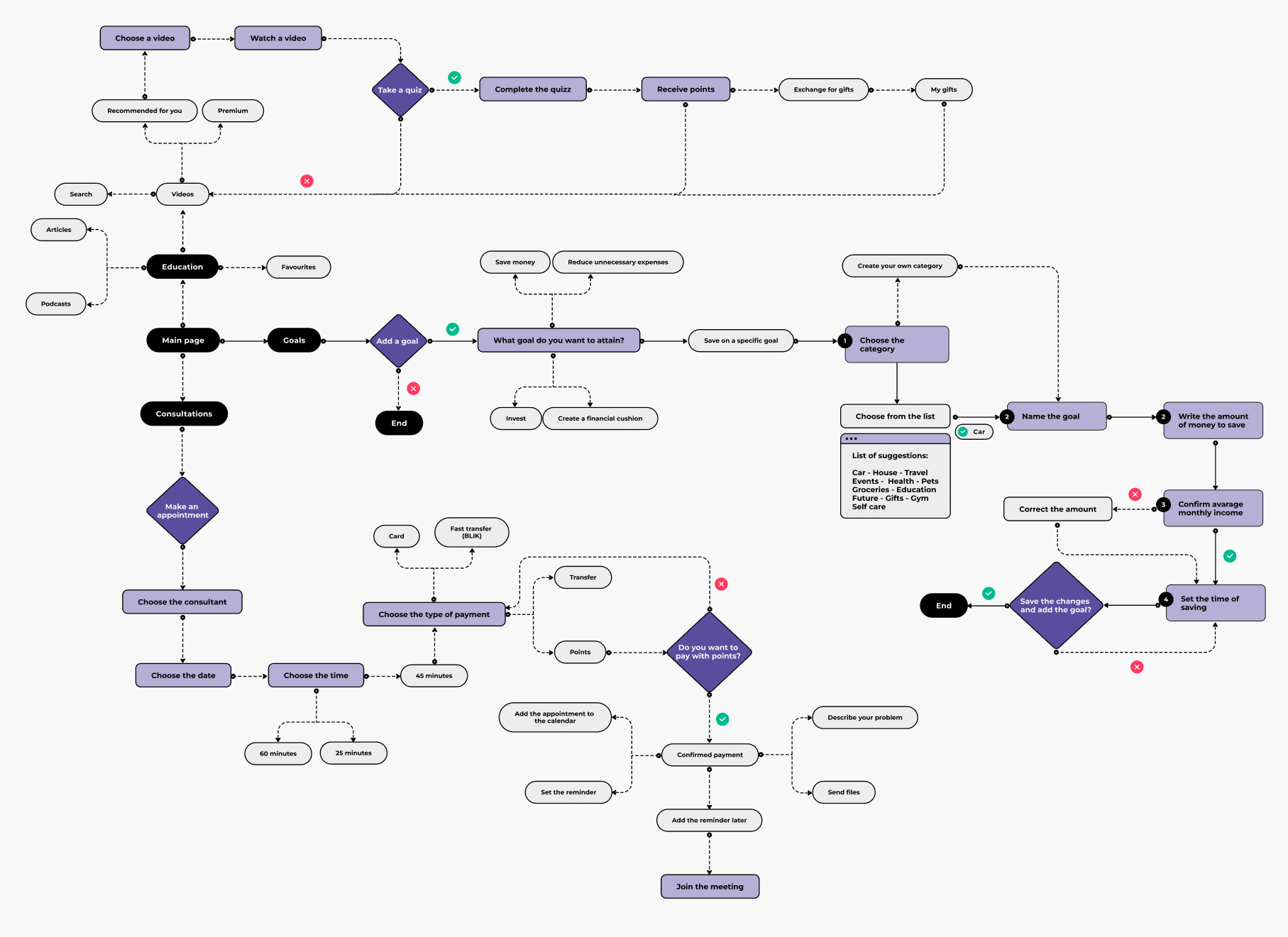

The time for the first sketches began. Our team divided work into three key branches of solutions. With that we created the main user flow, including registration, configuration and entry of basic parameters and most importantly:

three main paths as means to provide a broad horizon for the user in strengthening their knowledge and control over finances:

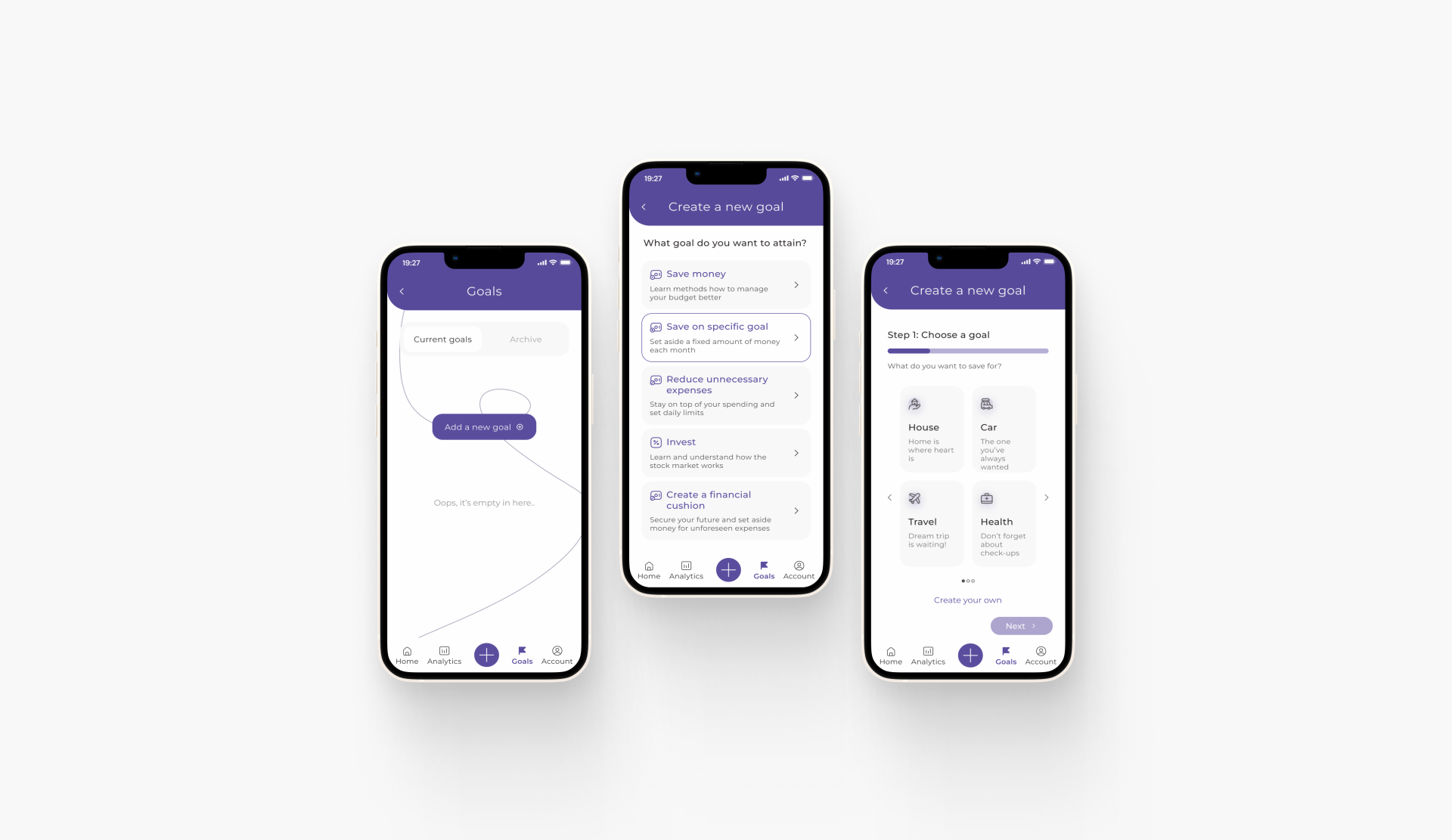

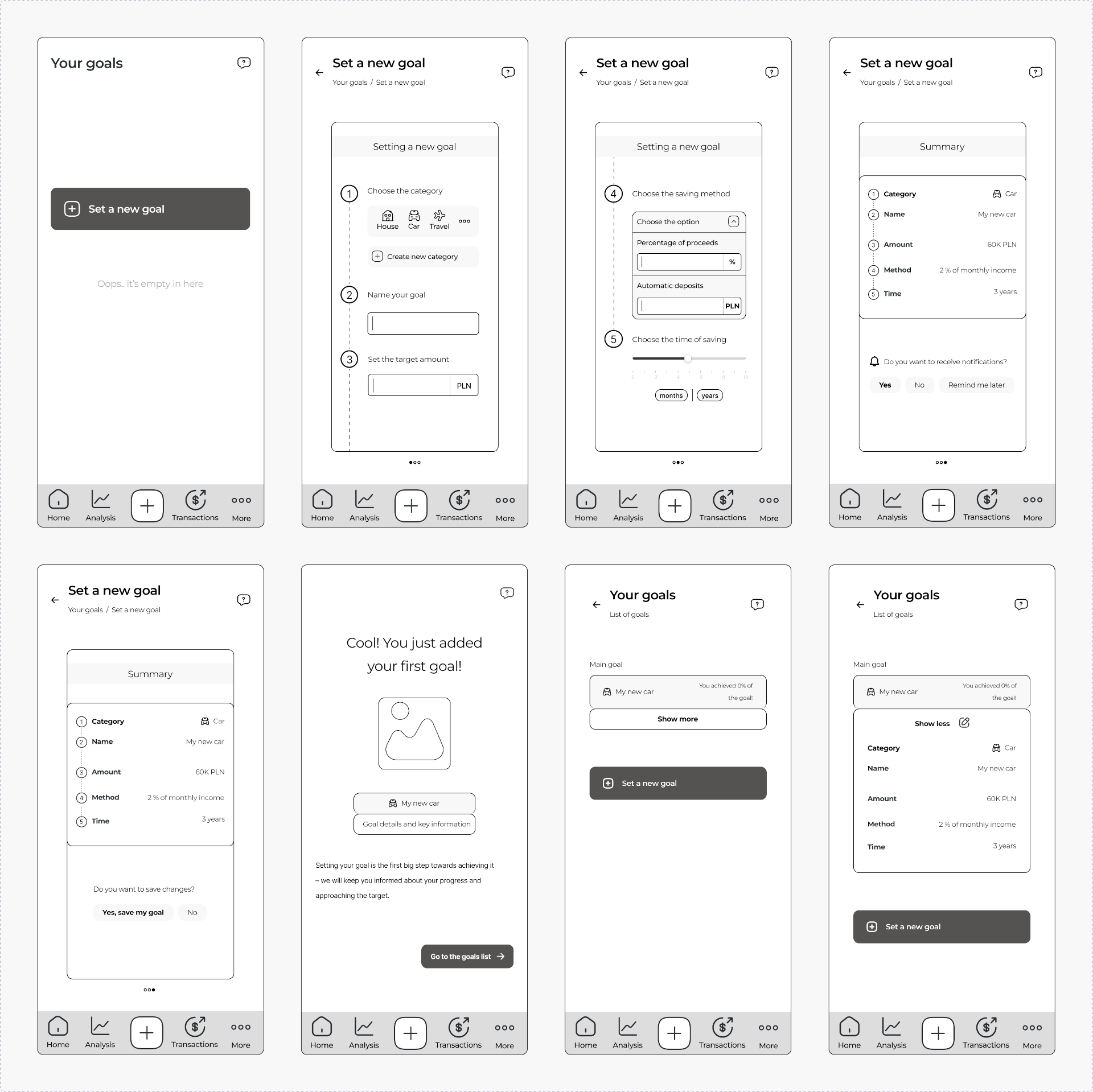

• Browsing the learning tab: a way to educate yourself in fun, engaging way • Arranging a consultation with a financial adviser: for a extra help from professionals • Creating a goal: as a mean to support dreams and make them come true

Trying out

To test out our idea each of us in the team created separate wireframes for the three main functionalities: browsing through education tab, making an appointment with financial consultant and creating a goal. I was responsible for preparing the last one.

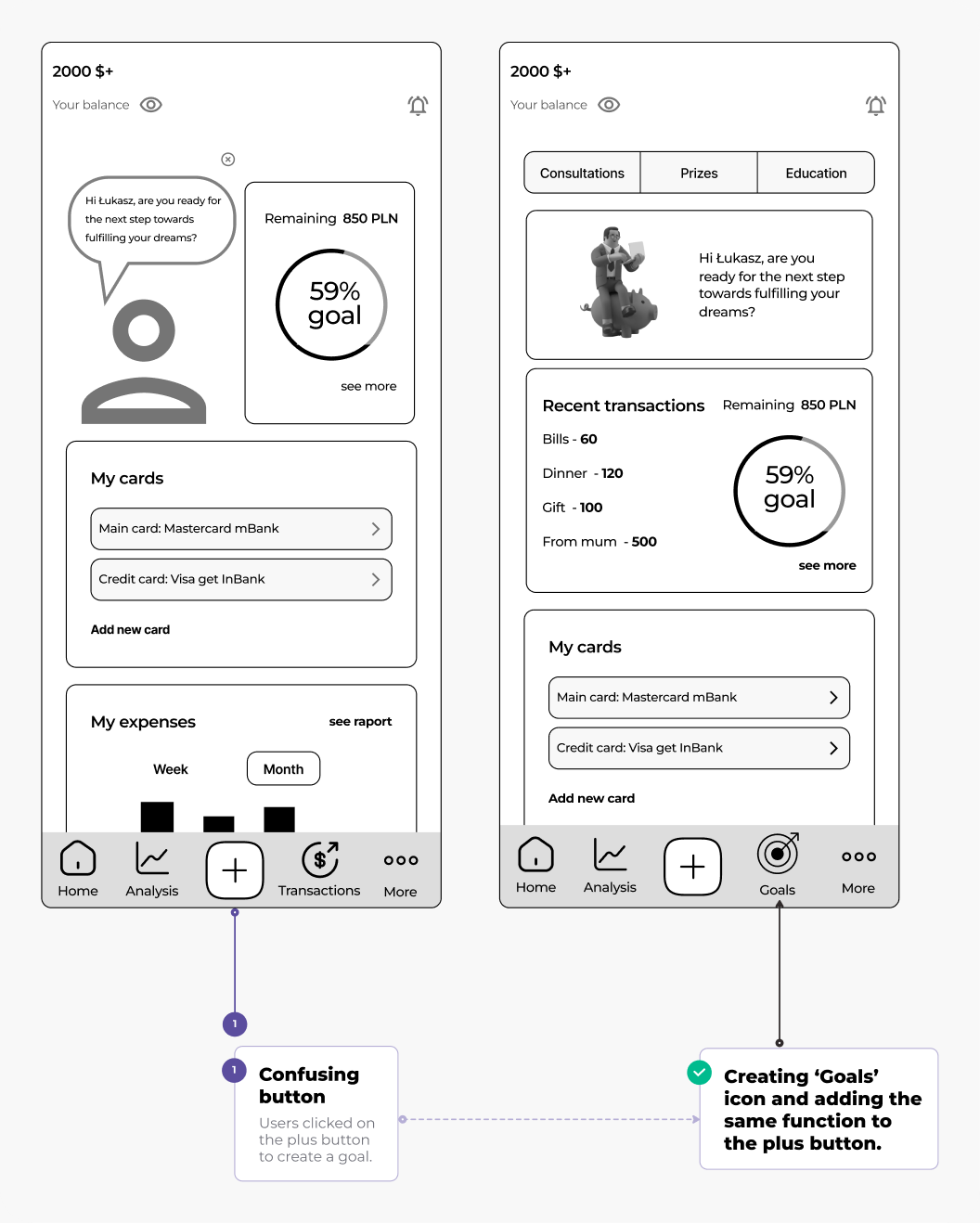

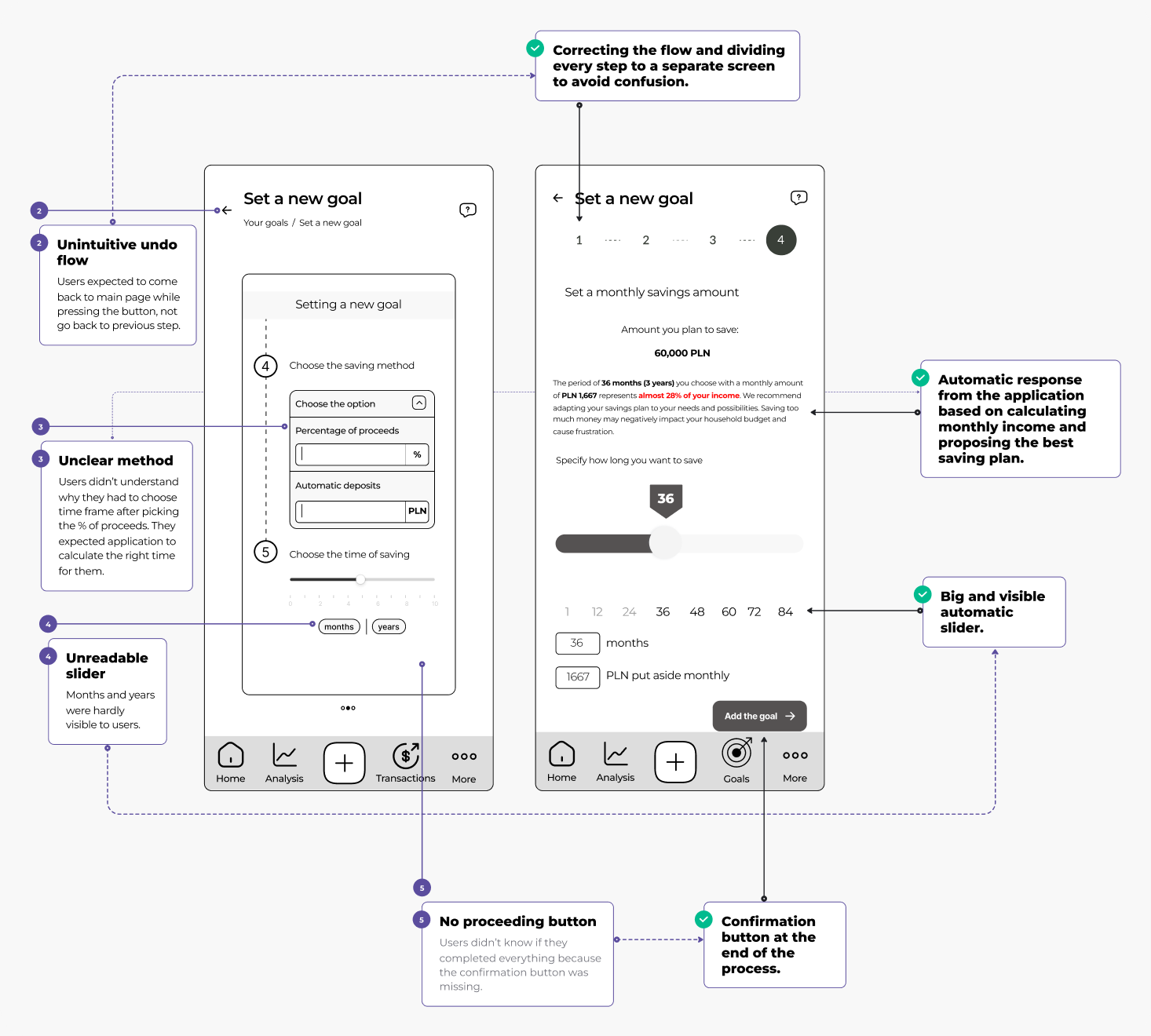

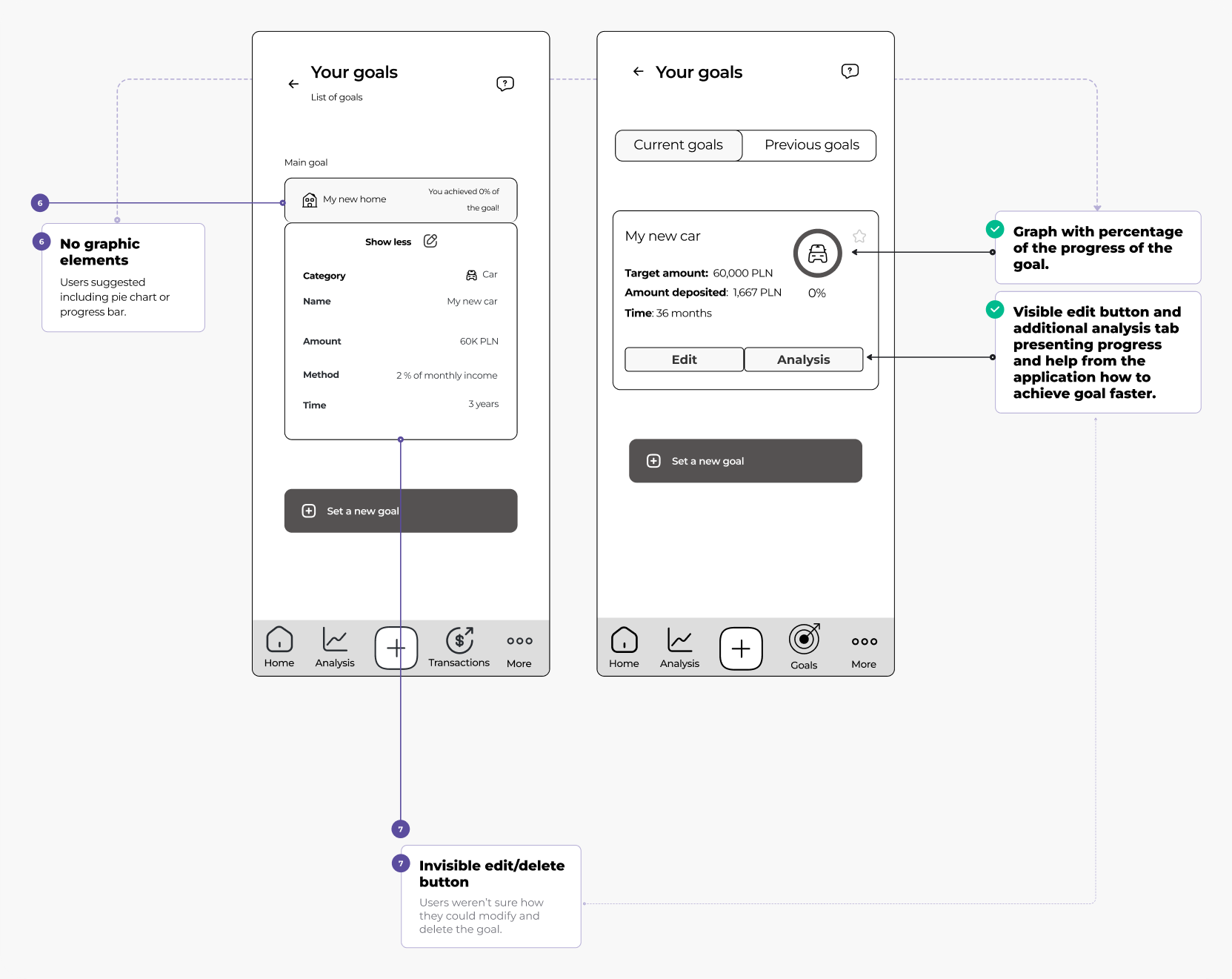

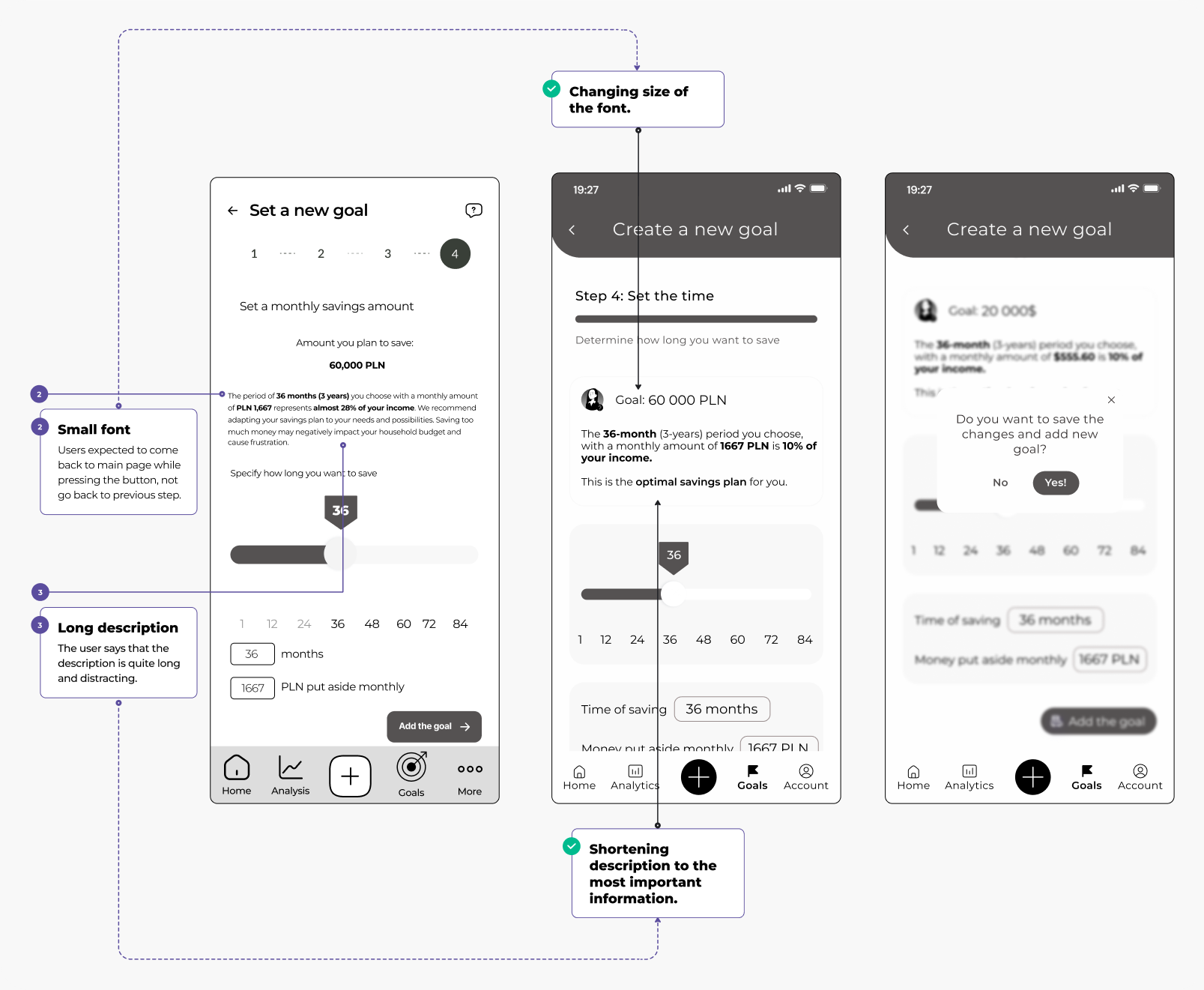

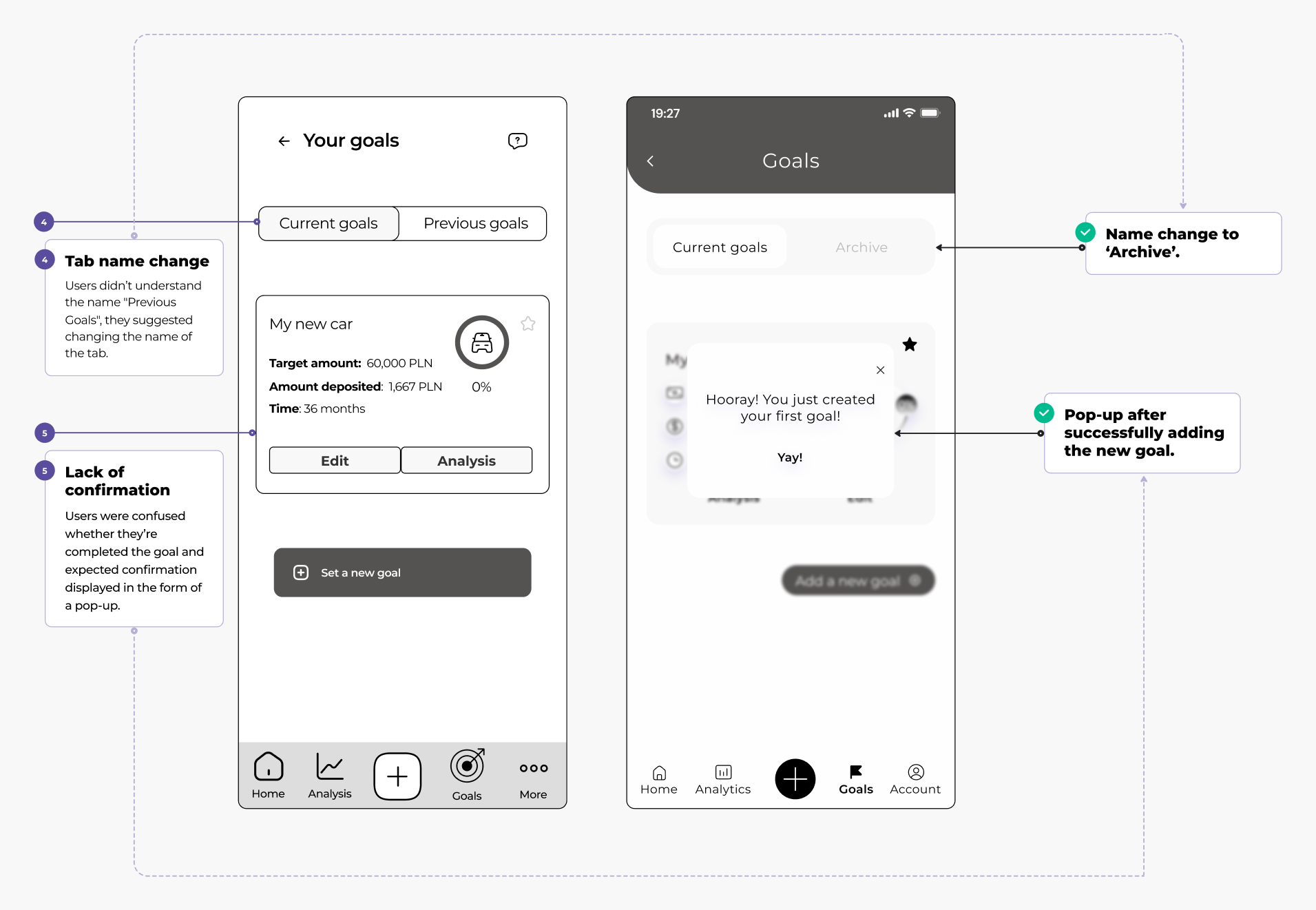

The first test With the first test performed tested on five people. Their task was to: 1. Make an appointment with a financial consultant 2. Browse the knowledge tab and take a quiz 3. Create a saving up goal During the test many issues emerged that were not clear to the users, they gave us many ideas and solutions. Many of these were duplicated and gave us ideas for improvements. Some of the changes include: creating separate icon for goal making, correcting readibility, improving the flow of a goal making proccess.

Always a room for improvement

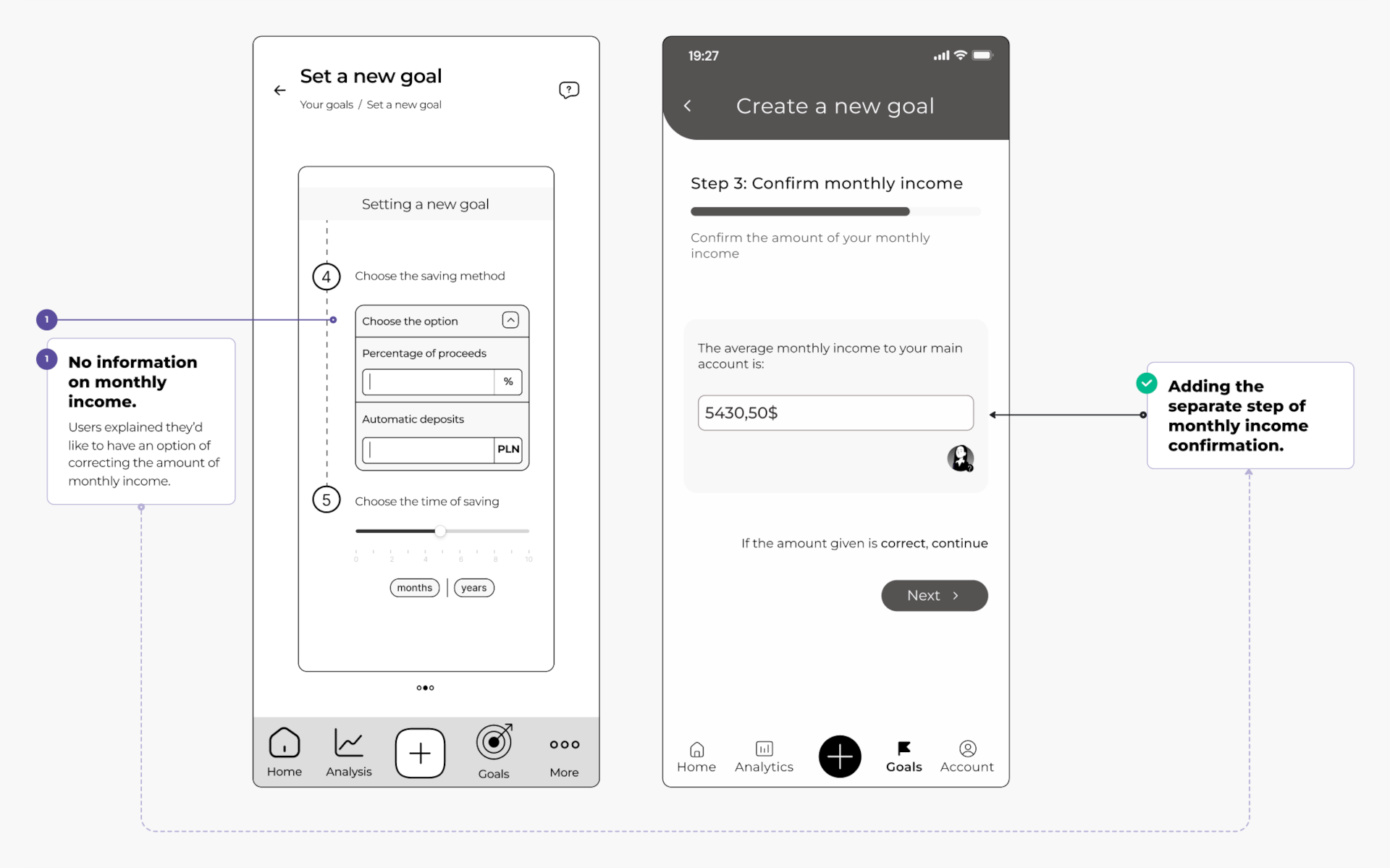

The improvements made were re-tested with 5 respondents. After the second round of testing, we prepared a short list of suggested changes, including the addition of personalised advice, new step, simplifying the language of interface.

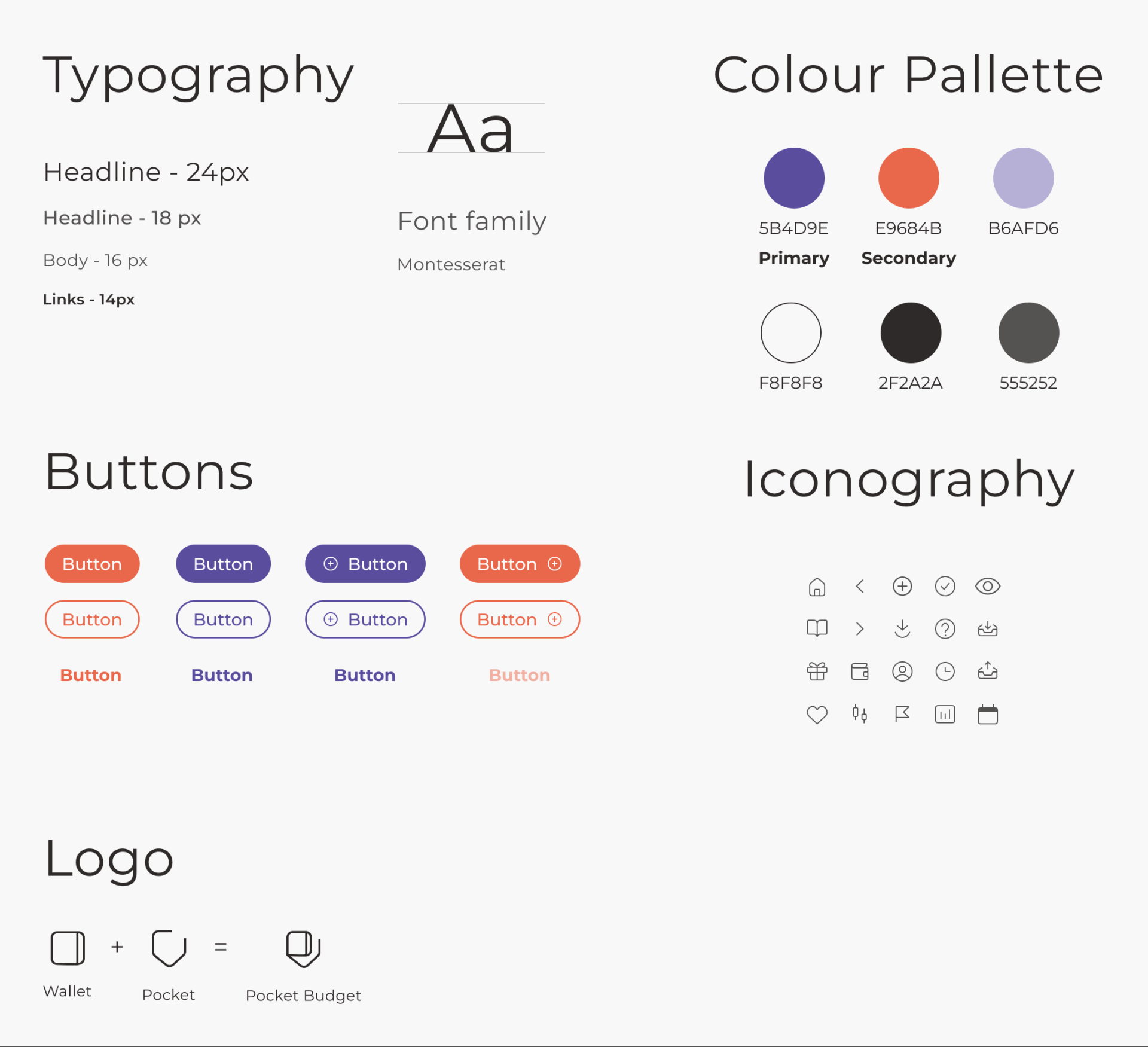

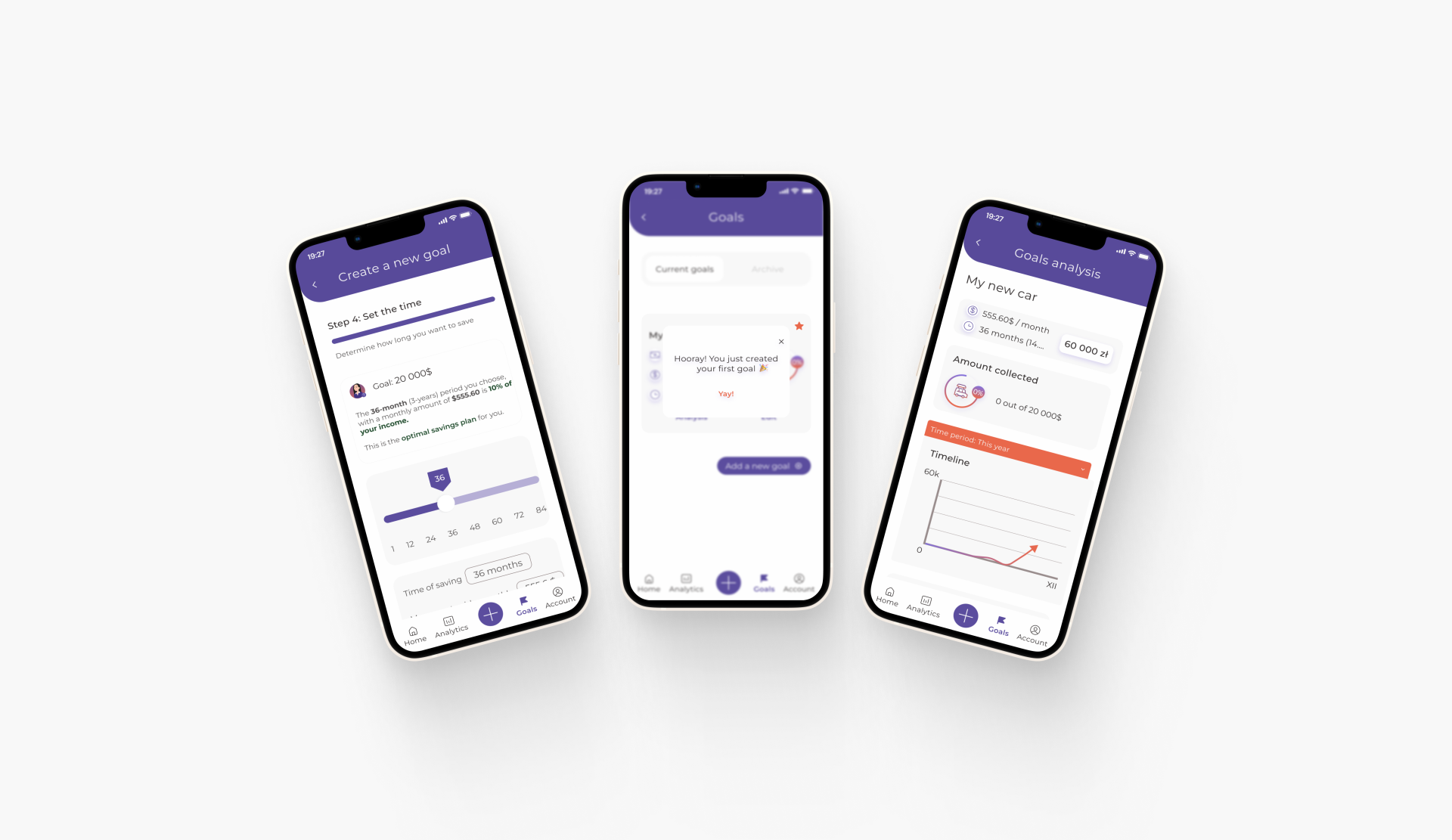

Optimistically in control

Being in control of finances should be associated with a strong but optimistic approach. We wanted PocketBudget to create a sense of both independence and trust.

Another important element was to ensure transparency, cleanliness and a modernist look for easy day-to-day financial management.

What’s next?

Further plans to improve the application include expanding the package of long-term plans to include family members or friends, further developing the avatar function using AI and enriching the tab with educational content.